CBDT Notification for ITR Date Extention

CBDT, in exercise of powers conferred under section 119 of the Income Tax Act, 1961, has extended the ‘due date’ of filing of returns of income for the A Y 2012-13 to 31st August 2012 in respect of assesses who are liable to file such returns by 31st July 2012 […]

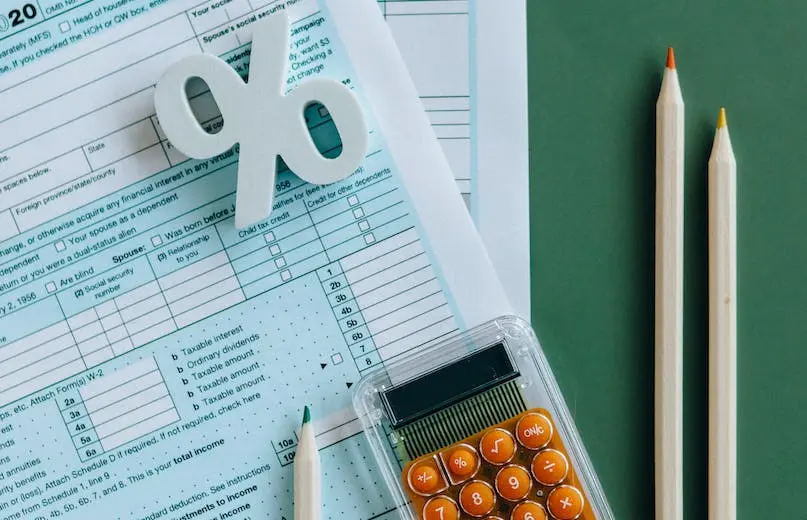

TDS RATES & LIMITS CHART (AY 2013-14)

TDS RATES & LIMITS CHART (A.Y. 2013-14) S.No Sec Nature of Payment in brief Cut Off Amount Rate % 01.04.12 01.07.12 HUF/IND Others 1 192 Salaries Salary income must be more then exemption limit after deductions Average Rate 2 193 Interest on debentures 2,500.00 5,000.00 10 10 3 194 Deemed […]

Advance Tax Provision for Individual, HUF, Corporate and other Non-Corporate Assesses

ADVANCE TAX – Individual, HUF and other Non- Corporate No Advance tax is payable if the total tax liability after reducing the tax deducted at source is less than Rs.10,000/- Senior citizens who do not have any income from business are exempted from payment of advance tax with effect from 01.04.2012 If Advance […]

Procedure for Registration of Sec 25 Company

Step-1 Apply in Form No. 1A to concerned ROC, for availability of name in order of preference (without addition to its name of the word “Limited” or the words “Private Limited”). Step-2 Prepare Memorandum & Articles of Association. Step-3 Make an application to the Concerned Regional Director for issue of […]

MCA Advise that corporate websites should contain a basic information

Voluntary Guidelines for Companies for providing general information on their websites about the company to promote good corporate governance and to enhance investors awareness The Ministry of Corporate Affairs (MCA) has been continuously taking various steps towards promoting good corporate governance, investor education and protection & advocacy for adoption […]

Service tax return date extended to 25th Nov from 25th Oct

Extension of time to file return in Form ST3F.No.137/99/2011-Service TaxGovernment of IndiaMinistry of FinanceDepartment of RevenueCentral Board of Excise & Customs New Delhi, the 15th October, 2012 ORDER NO: 3/2012 In exercise of the powers conferred by sub-rule(4) of rule 7 of the Service Tax Rules, 1994, the Central Board of Excise […]

Service Tax on Vocational Education/Training Course

Circular No. 164/15/2012-ST F. No. 356/17 /2012 – TRU […]

TDS applicability for Proprietorship firm or HUF

Is TDS applicable for Proprietorship firm or HUF? An individual or HUF has been made liable to make TDS only if his or its total sales, gross receipts or turnover from the business or profession carried on by him during the immediately preceding year (Previous Year) exceed the monitory limit […]

Very Soon TDS Correction Statement can be filed with Digital Signature only

CBDT has vide.Notification No. 3/2013, dated 15-1-2013 introduced ‘Centralised Processing of Statements of Tax Deducted at Source Scheme, 2013′ for centralized processing of statements of tax deducted at source. Vide clause 4 of the notification CBDT has specified that correction statement of tax deducted at source shall be furnished under […]

REFUND OF EXCESS TDS DEDUCTED/ PAID

Analysis of CIRCULAR NO. 2/2011 [F.NO. 385/25/2010-IT (B)], DATED 27-4-2011 If a deductor has deposited excess amount of TDS, the procedure for getting refund was given in Board Circular 285 dated 21-1-1980. Now CBDT has issued new circular in this respect. This Circular 2/2011 is issued in suppression of Circular No 285 / 21-10-1980 […]